Pharmacy Benefits Under OPD: Why Medicine Costs Shouldn’t Be Ignored?

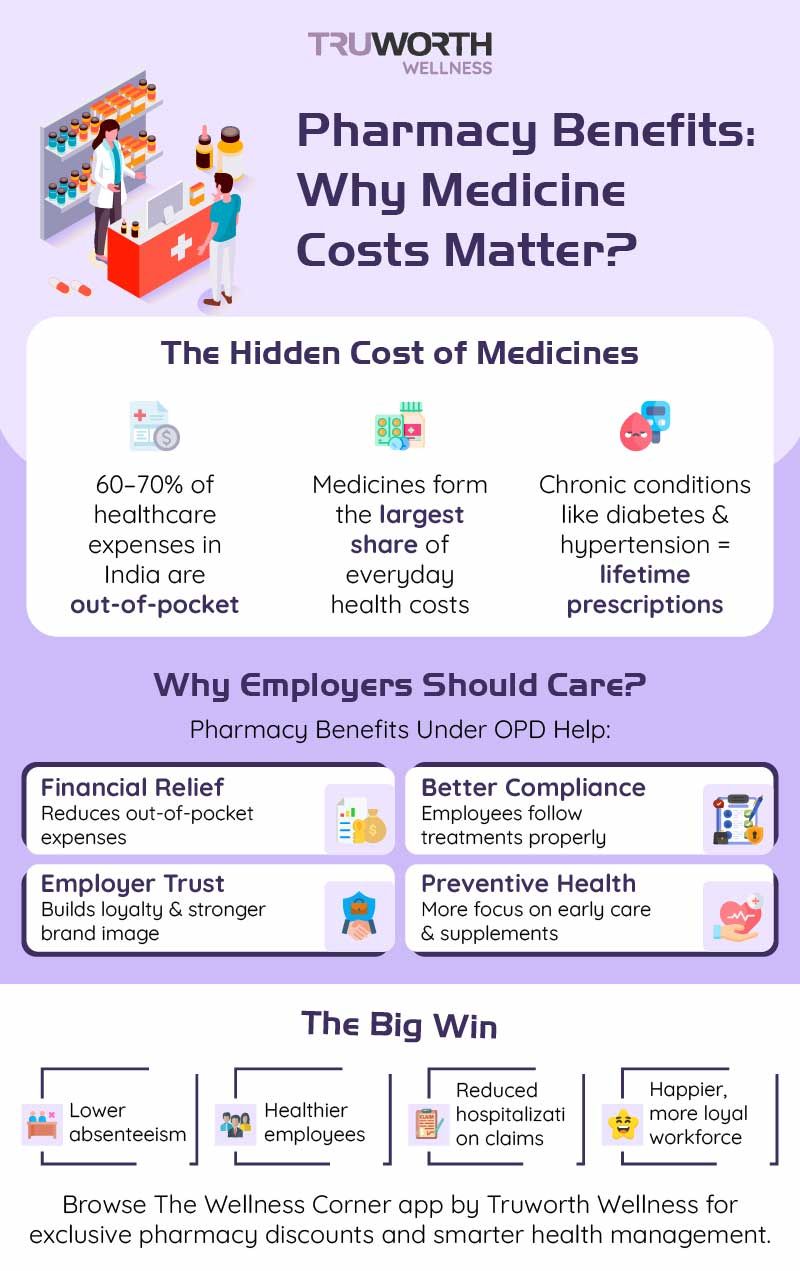

When we think about healthcare expenses, most of us picture hospital stays, surgeries, or emergency treatments. Insurance companies also place their focus here, promising big coverage amounts for critical events. But if you ask a working professional where most of their healthcare money goes, you’ll likely hear the same answer again and again: medicines. Prescription costs are the hidden giant in day-to-day healthcare spending. They may not make headlines like hospital bills, yet they quietly drain monthly budgets and have a direct impact on employees' well-being.

This is where OPD, or outpatient department coverage, steps in as a game changer. Unlike traditional insurance, OPD benefits provide support for doctor consultations, diagnostic tests, and, most importantly, medicines. Including pharmacy benefits under OPD is not just an option—it is a necessity in modern workforce healthcare.

The Hidden Weight of Medicine Costs

Think about the average employee’s household. Maybe there’s an elderly parent managing diabetes, a spouse on medication for thyroid issues, or a child who often needs antibiotics during seasonal infections. Even if hospitalization never happens in a year, medical bills will certainly arrive every month.

For chronic conditions, the expenses never pause. A single person with hypertension spends around ₹800 to ₹1,000 monthly on medication. Over twelve months, that’s roughly ₹12,000—an amount often paid from pocket without any financial cushion. If more than one family member depends on regular prescriptions, the overall cost increases significantly.

Even short-term illnesses add up. Treating the flu often requires antivirals, cough syrups, and supplements, with costs easily exceeding ₹1,500. When such incidents repeat throughout the year, they eat into salaries and savings more than people realize.

Ignoring these expenses is like ignoring everyday groceries while budgeting. It may seem small compared to hospital bills, but collectively, it is one of the most significant and recurring health costs employees face.

Why Employers Cannot Afford to Overlook Pharmacy Benefits?

Modern workplaces are waking up to the reality that employee health is not defined only by major medical emergencies. Everyday wellness is just as critical to productivity, satisfaction, and retention. When employees struggle with the affordability of medicines, it creates both financial and emotional stress. Employers who provide pharmacy benefits under OPD send a strong message—they care about the real health needs of their people.

1. Financial Security for Employees

Medicines are unavoidable. Unlike gym memberships or optional wellness perks, prescribed drugs cannot be skipped without consequences. Covering medicine costs ensures employees are not forced to dip into savings every month. This financial cushion makes them feel secure and supported by their organization.

2. Better Treatment Adherence

One of the silent crises in healthcare is that people often don’t complete their prescribed courses or skip doses to save money. A hypertensive employee might cut tablets in half or delay refilling. Someone with a recurring infection may stop taking antibiotics mid-way because they’re too expensive. These practices eventually worsen health and can lead to hospitalization. By covering pharmacy expenses, employers encourage employees to adhere to treatment, leading to improved long-term health outcomes.

3. Support for Preventive Care

Health isn’t just about curing illness; it’s also about prevention. Many doctors prescribe vitamins, supplements, or lifestyle medications to prevent conditions from escalating. But when employees have to pay out of pocket, they often ignore preventive prescriptions. With pharmacy benefits included, employees are more likely to invest in preventive care, lowering the risk of severe health issues later.

4. Stronger Employer Brand

Today’s workforce evaluates companies not only on salary and career growth but also on how much the organization cares for their well-being. Offering OPD with pharmacy coverage is a practical benefit that employees can feel every month. It fosters trust, strengthens loyalty, and makes the company an employer of choice.

How OPD with Pharmacy Benefits Works

Unlike hospitalization insurance, which employees may or may not use in a year, OPD with pharmacy coverage is a benefit that almost everyone uses regularly. A well-designed plan can cover:

Prescription medicines for both chronic and acute conditions

Family members’ medication needs, since dependents often consume the largest share of medicines

Both branded and generic options, giving flexibility to employees and cost efficiency to employers

Digital convenience, such as e-prescriptions and online pharmacy tie-ups, is making access smoother and more transparent

Such coverage ensures that the benefit is not just theoretical but practical, impactful, and widely appreciated.

Also Read: OPD Wellness Program: What To Expect? (A Guide For Patients)

A More Human Perspective

Consider how employees feel when they leave a doctor’s clinic. The consultation might be affordable, but the real pinch happens at the pharmacy counter. They pull out their wallets and wonder how much this will cost them this time. Some silently calculate what to cut back on in their personal budget to balance out the month. Others weigh whether all the prescribed medicines are truly necessary.

Now imagine the relief of knowing that these costs are covered under their health benefits. That sense of support translates directly into peace of mind. Employees can focus on recovery, families can manage chronic conditions without stress, and the workplace benefits from a healthier, more present workforce.

Why It Matters in the Bigger Healthcare Landscape

India is witnessing a steady rise in chronic lifestyle diseases. Hypertension, diabetes, obesity, and mental health conditions are affecting employees earlier in life. These illnesses rarely require immediate hospitalization but almost always require consistent medication. The absence of pharmacy coverage leaves a gap in the healthcare safety net that most insurance policies don’t address.

By bridging this gap, employers not only protect employees but also reduce their own long-term costs. A worker who adheres to medication for diabetes is less likely to develop complications that require hospitalization later. This translates into fewer insurance claims, lower absenteeism, and higher productivity. In essence, pharmacy benefits under OPD are not an expense for the company—they are an investment in sustainable workforce health.

Practical Tips for Employers

For organizations considering OPD pharmacy benefits, a few simple guidelines can make implementation more effective:

- Employers should offer flexibility for employees to choose between physical and online pharmacies.

- Coverage should also include dependents, as families often contribute significantly to the cost of medicines.

- Using data insights while ensuring privacy can help organizations understand common medicine needs and plan preventive wellness programs accordingly.

- It is just as important to communicate the benefit clearly so employees understand how and when to use it.

The Bottom Line

Medicine costs may not be dramatic like hospital bills, but they quietly shape the financial and emotional health of employees and their families. When ignored, they lead to skipped treatments, unmanaged conditions, and bigger healthcare burdens later. When addressed through OPD coverage, they provide relief, promote healthier habits, and build stronger trust between employers and employees.

Organizations that recognize everyday healthcare needs, rather than only emergencies, will lead the way in creating workplaces that truly care. Including pharmacy benefits under OPD is one of the most impactful steps an employer can take.