Habits That Drain Money Faster Without You Actually Realising

Why Financial Wellness Has Become a Workplace Stability Strategy?

In a typical workweek, you track so many things with precision. Your schedules, deliverables, meeting notes, and deadlines. Yet the one thing that quietly influences your peace of mind, daily decisions, and overall well-being often goes untracked: your spending patterns.

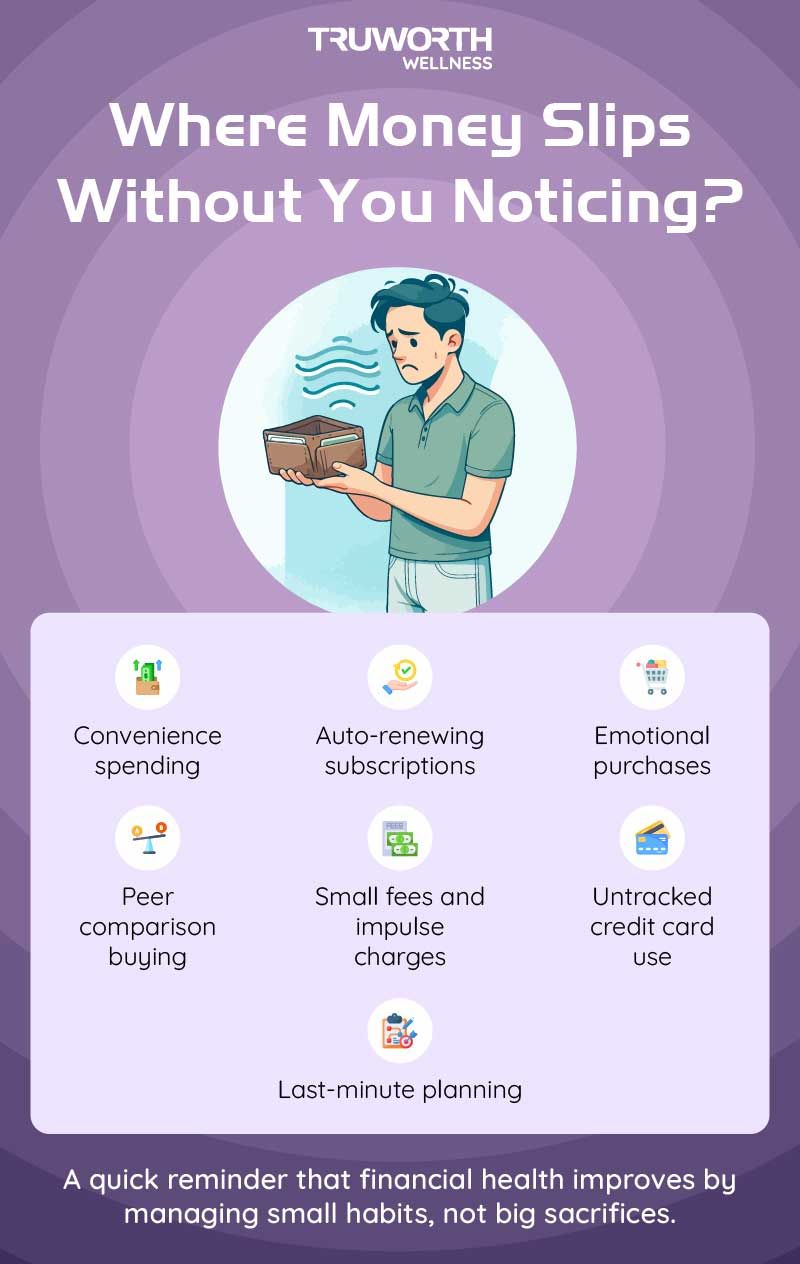

Most working professionals today don’t lose money because of one big, irresponsible purchase. Money slips away through small, familiar, automatic habits that feel harmless. These behaviours operate quietly in the background while you are busy managing work, deadlines, and commitments. Over time, they reduce financial stability, increase mental load, and silently push you closer to stress and burnout.

Below are the everyday money-draining habits you may not even realize are shaping your financial health.

Also Read: How Can Companies Help Employees Cut Their Expenses?

1) The Convenience Purchases You Forgot To Count

In corporate life, convenience feels like a necessity. When calls extend beyond lunch hours, deadlines tighten, or you’re simply too exhausted to cook, ordering food seems like the easiest choice. A coffee bought during a rushed morning, a mid-day snack from the cafeteria, or a quick dinner delivery after a long day each feels insignificant.

The challenge is not these individual purchases. It’s the frequency and the lack of awareness around them. When you rely on convenience every day, these tiny expenses quietly add up to a significant chunk of your monthly income. By the time you check your statement, you are surprised at how much went into daily comfort rather than planned expenditure.

Convenience is valuable, but unconscious convenience becomes costly.

2) Mindless Subscriptions That Renew Automatically

Subscriptions are designed to feel effortless. A gym membership that automatically renews, an entertainment platform you barely use, a fitness app you downloaded with enthusiasm and never opened again. These payments continue without making any noise.

Once they renew on their own, you rarely question whether you still need them. The effort of cancelling seems bigger than the small amount being deducted monthly, so you let it go. What starts as ₹199 or ₹399 a month becomes a recurring hole in your financial plans.

Even in the corporate world, many employees pay for tools, productivity apps, or online services out of habit, not necessity. Unused subscriptions become one of the most common sources of silent financial leakage.

3) Emotional Spending After a Long Workday

After a draining day, your mind often seeks relief. Emotional spending is not always extravagant; most of the time, it is small, impulsive, and mood-driven. Ordering comfort food after a tiring meeting, shopping online because a notification popped up, or rewarding yourself with treats because "I deserve this" are decisions made emotionally, not logically.

The problem isn't treating yourself. It’s the pattern that forms when spending becomes the primary response to emotional exhaustion. Stress weakens decision-making. Fatigue lowers self-control. This combination leads to purchases that bring momentary comfort but long-term regret.

For working professionals, emotional spending is the financial consequence of unmanaged stress.

3) Buying Because Everyone Else Is

The corporate environment sometimes creates silent comparison traps. A colleague buys the latest phone. Someone else upgrades their laptop or purchases a premium bag. Another coworker travels frequently or invests in luxury services. These things subtly influence how you view your own lifestyle.

Without realizing it, you may start making purchases to maintain a certain image or stay aligned with your peer group. Yet your financial goals, responsibilities, and priorities are completely different from theirs.

Comparison-based spending is one of the most impactful financial drains because it is driven not by need but by perception. It creates pressure to spend more to fit in, not to progress.

4) Ignoring Small Financial Leaks

There are expenses so tiny that your mind discounts them instantly. Delivery fees. Late payment charges. ATM withdrawal fees. Impulse buys under "only ₹99". These do not feel like real expenses, which is why they go unnoticed.

But financial wellness is shaped by consistency, not size. Even small leaks, when repeated daily or weekly, build up into significant monthly losses. These charges do not hurt individually. The harm lies in how quietly they accumulate.

Ignoring these micro-leaks reduces your saving potential without giving you anything meaningful in return.

Also Read: Financial Wellness Program At Workplace: Things To Know

5) Last-Minute Planning That Leads To Expensive Choices

Rushed decisions always cost more. When travel tickets are booked last minute, prices are higher. When you forget essentials and buy them urgently, you pay convenience charges. When events or trips are planned in a hurry, you lose access to early-bird rates or better options.

Working professionals often fall into this pattern because time is limited and schedules are packed. But last-minute planning becomes a recurring financial penalty. You’re not paying for the product, but for urgency.

The more reactive your planning, the more money you unintentionally waste.

6) Over-Reliance on Credit Cards

Credit cards make life smoother, but they also create illusionary comfort. When you swipe without tracking, you lose visibility of how much you’ve spent. The bill arrives weeks later, often higher than expected, leaving you stressed.

Using a credit card isn’t wrong. But depending on it without awareness is dangerous. Many professionals use future earnings to pay for present moods. This cycle builds financial pressure and restricts long-term growth.

When the repayment cycle becomes heavier than your actual expenses, your card stops being a tool and becomes a burden.

7) Confusing “Rewarding Yourself” With Overspending

Rewards are healthy. They motivate, uplift, and offer emotional balance. However, when the idea of rewarding yourself becomes frequent, exaggerated, or unplanned, it turns into a financial drain.

Buying expensive items after every achievement, ordering gourmet meals every weekend, or indulging in premium services regularly may feel like self-care. But genuine self-care improves your well-being, not your stress levels.

Rewarding yourself should be intentional, not impulsive.

Why These Habits Matter in the Workplace?

Financial stress is one of the least spoken yet most common forms of workplace stress. When people struggle with money management, it affects concentration, decision-making, sleep patterns, emotional stability, and energy levels.

Employees who feel financially secure show better engagement, productivity, and mental resilience. That is why financial wellness is not just a personal priority but an organisational responsibility.

How Organisations Can Support Better Money Habits?

Financial well-being programs are becoming essential in modern workplaces. Organisations can support employees by offering:

• Sessions on money psychology and behaviour

• Workshops on budgeting, smart planning, and tracking habits

• Webinars on debt management and mindful credit use

• Tools that help employees manage spending and financial goals

• Nudges that inspire conscious, balanced financial decisions

When companies invest in financial wellness, employees experience reduced stress, improved clarity, and better long-term stability.

Final Word

Money doesn’t disappear dramatically. It disappears quietly through tiny choices you barely notice. When you become mindful of these patterns, your financial confidence grows. And when organisations create a supportive environment through structured financial wellness initiatives, it becomes easier for employees to build stability, reduce worry, and feel more secure.